Financial Lifebook Session Details

Session 5

How to Make Money Work For You

We all figure out how to make money, the problem is that money does not come with an instruction booklet. In high school we are taught how to dissect frogs and not taught how to make it in life financially. We are not taught how to set up a family budget, how to properly balance a checkbook, how to buy life insurance and mutual funds. We are not taught the basics that we should be taught in order to succeed financially. We all seem to figure it out along the way with some doing a better job than others. This is not something that should be just left to chance. It is imperative that we know about money and what to do with it.

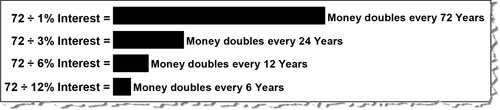

We make a lot of money during our lives but never seem to put any away for the future. In fact, if you take your annual earnings and multiply it by 30 years, you will see how much earning potential you really have. Keep in mind that money will work for you 24 hours a day 7 days a week. It never goes to sleep; it won’t take vacations or time off. How much have you figured out about money? Do you really understand the difference between simple interest and compound interest? Did you know the famous Albert Einstein is credited with discovering compound interest, which is known as the Rule of 72? Referring to compound interest, Albert Einstein is quoted as saying: “It is the greatest mathematical discovery of all time”

We will learn the Rule of 72 and look at how it can work for us if we know how to use it or how it can work against us. Are you ready for money to work for you instead of you working for money? We will show you how!

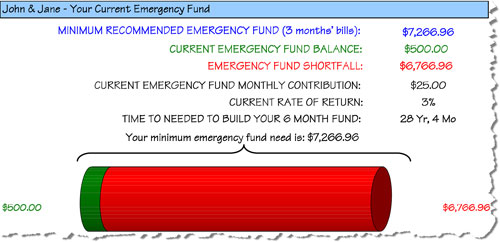

The purpose of an emergency fund is to provide a "cushion" against unforeseen events and minor financial problems that can occur without notice. Many different circumstances could bring a negative financial impact on the family and its budget - unemployment, medical bills, car problems, and many others. An adequate Emergency Fund, which is covered in your Blueprint, should contain a minimum of at least three months fixed expenses, with the ultimate goal being six months worth of fixed expenses. We will discuss why having an emergency fund is important, define your current emergency fund needs, the types of funds that are available to build an emergency fund and what discipline is necessary to maintain your emergency fund.