In this Section

Build Your Financial House: Step 3

The House You Live In

Your physical house, your home, is built to provide a secure physical environment for you and your family. You have a strong foundation, walls, a roof and a sturdy outside wall for protection. Your financial house should be just as important as your physical house. Just as your physical house has four components, so should your financial house. Throughout this Financial Framework Seminar Series™ we are going to focus on helping you create a strong, secure financial house.

Your Financial House: Step 3 – Proper Protection

Build Your Roof

A simple definition of life insurance is that it offers a way to replace the loss of income, or recover

increased expense that occurs when someone dies, especially the main breadwinner of the family. Life

insurance does not “insure a person’s life” so much as it “protects the dependents” from the loss of

financial support. A life insurance policy is a contract between an individual as the insured person and

the company or “carrier” that is providing the insurance coverage. If the insured dies while the contract

is in force, the insurance company (carrier) pays a specified sum of money free of income tax (the cash

benefits) to the person or people named as beneficiaries.

1 Timothy 5:8 But if anyone does not provide for his own, and especially for those of his household, he has denied the faith and is worse than an unbeliever.

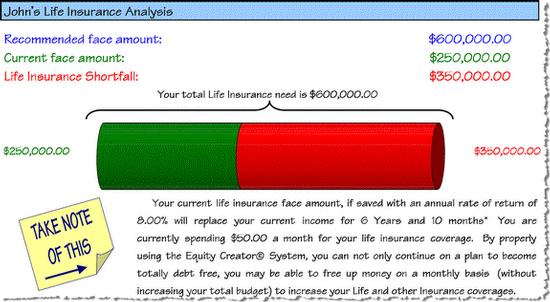

Statistically, most American families do not have enough life insurance in place to replace the income of the breadwinner, if he/she dies prematurely. In such cases, a terrible burden is left for the surviving family to contend with. Your personalized Equity Creator® Financial Blueprint will detail your Life Insurance information. No guessing, no trying to figure it out, and it will even show how long what you currently have will take care of your family if something were to happen to you. Take a look at the sample chart below:

The important thing when looking at your insurance needs is to be sure you have proper coverage during your “Peak Responsibility Period”. This is the time when you have young children still at home, high mortgage amount, and high debt. This is usually in your younger years since as you get older, your children are no longer living at home, your overall debt is usually lower, and finally, you have accumulated other types of saving vehicles. In this situation, term insurance is usually better because you can get more coverage for less money. Remember, insurance is purchased to cover the income you will need to meet your responsibilities, when your house is now paid off and you have no children at home, your insurance coverage will not need to be as high.

Session 4 of the Financial Framework Seminar Series™ explains what every person should know about Life Insurance in order to be an “Educated Consumer”. If you need any assistance or information you have access to the Equity Creator® Coach that is assigned to your church. The Coach service is available to you without any charge and will assist you in the construction of your Financial House.