In this Section

Build Your Financial House: Step 4

The House You Live In

Your physical house, your home, is built to provide a secure physical environment for you and your family. You have a strong foundation, walls, a roof and a sturdy outside wall for protection. Your financial house should be just as important as your physical house. Just as your physical house has four components, so should your financial house. Throughout this Financial Framework Seminar Series™ we are going to focus on helping you create a strong, secure financial house.

Your Financial House: Step 4 – Retirement Savings

Build Your Exterior

What Does Retirement Mean To You? Retirement is a word that has a different meaning for everyone.

Some may see their retirement as being a carefree time with no particular place to be. Others may see

it as spending time with family and taking vacations. Still to others they may see it as time to work on

the hobbies they never could when working full time. The possibilities are endless; what will it mean to

you? What do you picture for your retirement years? Will your financial situation allow you to live that

picture?

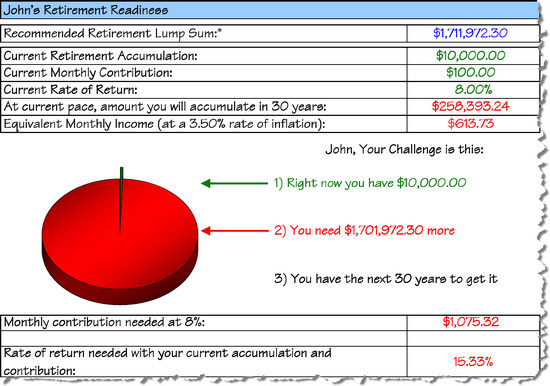

Most people in our country have absolutely no idea how much they need to save for retirement. You however, are not one of them. Your personalized Equity Creator® Financial Blueprint has your retirement needs figured out for you. When you first see your retirement numbers in your Blueprint you will be shocked. Most people will need in excess of $1 million dollars when they retire. But, by using the Equity Creator® System and spending their same current monthly payments they can

accomplish their retirement goals.

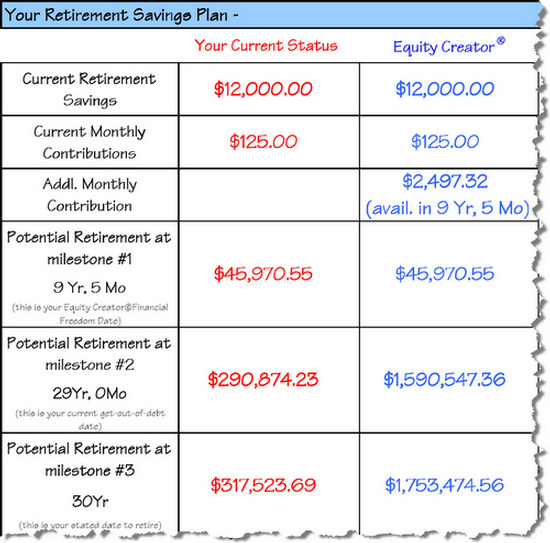

In the back of your personalized Equity Creator® Financial Blueprint you will find the Program Summary Page. The Red column will represent your current financial situation and the Blue column shows what will happen if you follow your Blueprint through to completion. The sample chart to the right is the bottom half of the chart which covers your Retirement Savings. Notice in this example that you are debt free (including your mortgage) in 9 years and 5 months. At this time you would redirect your monthly debt money into your retirement account. At Milestone #2 in the chart, which represents when you would have originally paid off your debts, notice the difference from the

Red

column and the Blue column. There is a $1,299,669 dollar difference. Keep in mind, you have spent the same monthly payment through out the entire 29 year period. You did not have to add any additional funds or sell your stuff to make this happen. All you have to do is follow your customized plan!

Session 6 of the Financial Framework Seminar Series™ teaches you how to anticipate and plan for your retirement needs. If you need any assistance or information you have access to the Equity Creator® Coach that is assigned to your church. The Coach service is available to you without any charge and will assist you in the construction of your Financial House.

Proverbs 24: 3-4 3 By wisdom a house is built, and through understanding it is established; 4 through knowledge its rooms are filled with rare and beautiful treasures.